Combined loan to value (CLTV): How to calculate and examples

Learn what combined loan-to-value (CLTV) means, how it differs from LTV, why it's important for home equity, its formula, and ways to improve your ratio.

Read more

Learn what combined loan-to-value (CLTV) means, how it differs from LTV, why it's important for home equity, its formula, and ways to improve your ratio.

Read more

Learn how to finance home renovation with and without equity. Compare financing options, estimate project costs, and get tips to budget and plan confidently.

Read more

Find out the documents needed for mortgage pre-approval and special circumstances. Use our smart checklist to prepare, stay organized, and buy confidently.

Read more

Learn what an appraisal waiver is, how it works for buyers and lenders, key steps to qualify, and the pros and cons of skipping a traditional home appraisal.

Read more

Compare reverse mortgage vs. HELOC vs. home equity loans: who qualifies, how they work, costs, pros and cons, and when each option makes sense for your goals.

Read more

Explore the types of refinance options available to homeowners. Learn how rate-and-term, cash-out, and other refinance types can help you save or access equity.

Read more

Discover alternatives on how to get equity out of your home without refinancing. Learn about HELOCs, home equity loans, and other flexible financing options.

Read more

Discover how a VA IRRRL can cut your rate and payment with fewer documents, no appraisal, and rolled in costs. Start your streamlined veteran refinance today.

Read more

Protect your new home with safety measures designed to combat the risk of fire, carbon monoxide poisoning, flooding, and burglary.

Read more

Confused about no cash out refinance vs. limited cash out refinance? Discover the benefits, differences, and which option is best for your mortgage strategy.

Read more

Should you refinance your mortgage? From lowering your monthly payments to getting cash-out, here are some ways you may benefit from refinancing.

Read more

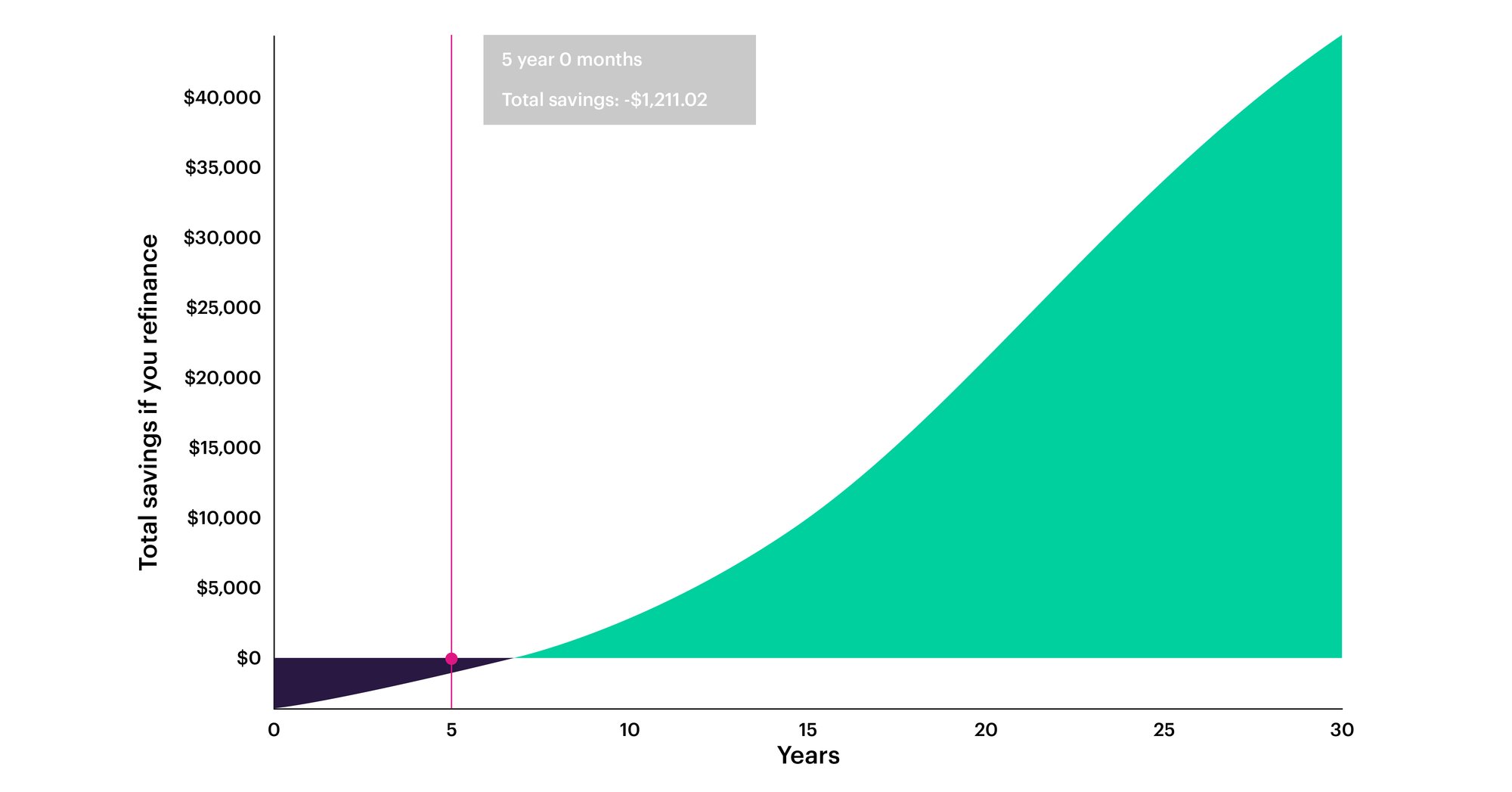

Try this refinance calculator to understand how much you could save if you refinance your mortgage.

Read more

Conventional loans are the most common mortgage type in the US. Here we explain what makes them different from other mortgage options and how to get one.

Read more

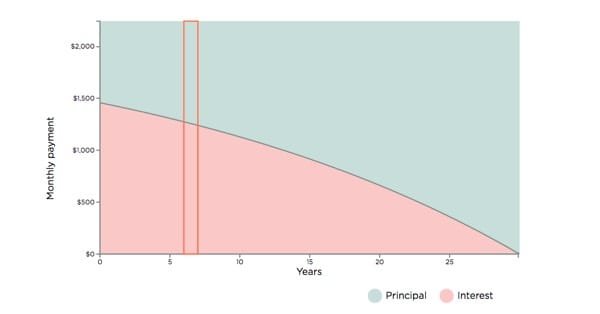

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

Here’s how much home prices and average interest rates have risen since 1950.

Read more

Jumbo loans are mortgage loans that have a higher-than-normal balance. Here's what you need to know about securing this type of financing in 2021.

Read more

Explore the essentials of buying an Airbnb investment property with Better.com. Learn about market research, property types, financing options, and the pros and cons of Airbnb investments. Get expert tips...

Read more

Looking to buy a property that makes money for you? Learn the minimum qualification requirements to get a mortgage pre approval for an investment property.

Read more

Discover how loan subordination lets you refinance while keeping a second mortgage: What it is, how it works, key steps, and why it’s important.

Read more

Low-income homeowners who were previously denied a mortgage refinance may now qualify through RefiNow™. You may save up to $3k/yr by lowering your monthly costs.

Read more

Need something else? You can find more info in our FAQ